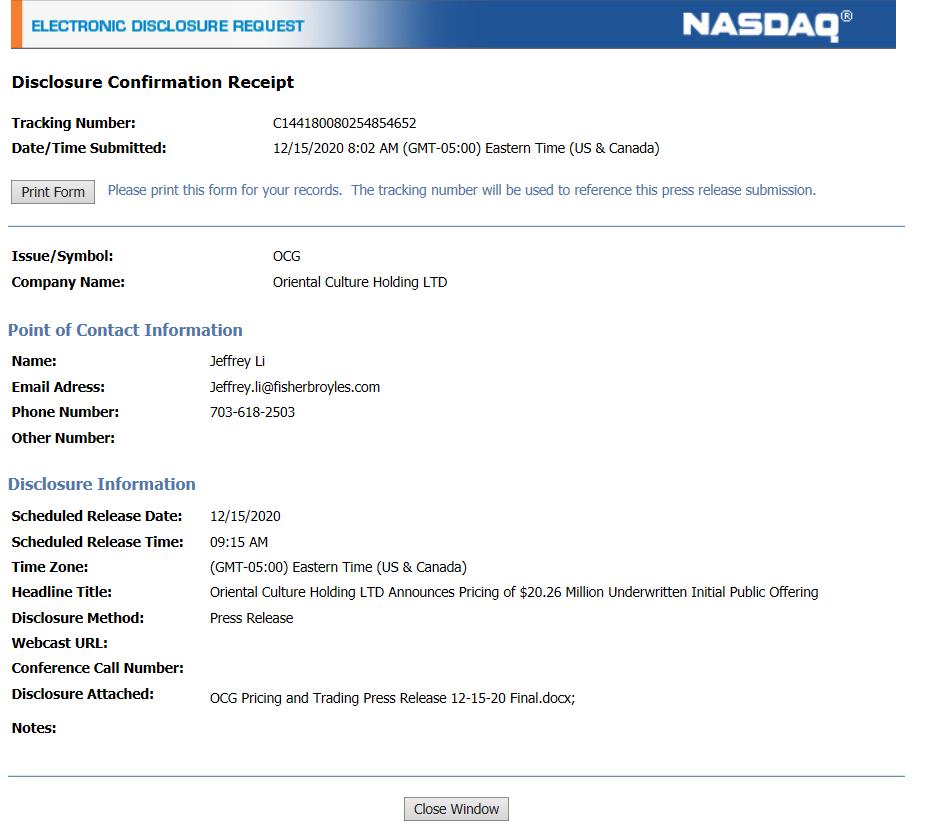

Oriental Culture Holding LTD Announces Pricing of $20.26 Million Underwritten Initial Public Offering

Hong Kong, China, December 15, 2020/ -- Oriental Culture Holding LTD (“OCG” or the “Company”) (NASDAQ: OCG), a leading online provider focusing on collectibles and artwork e-commerce services, today announced the pricing of its underwritten initial public offering of 5,065,000 ordinary shares at a public offering price of $4.00 per share, for total gross proceeds of approximately $20.26 million before deducting underwriting discounts and commissions and offering expenses. The offering is being conducted on a firm commitment basis. All of the ordinary shares are being offered by the Company. The ordinary shares have been approved for listing on The Nasdaq Capital Market and are expected to commence trading today, December 15, 2020, under the ticker symbol “OCG.”

The Company has granted the underwriters an option, exercisable within 45 days from the date of the final prospectus, to purchase up to an additional 759,750 shares at the public offering price, less underwriting discounts and commissions.

The offering is expected to close on December 17, 2020, subject to customary closing conditions.

ViewTrade Securities, Inc., a global provider of brokerage, investment banking, corporate/advisory and trading platform services, acted as sole book-running manager for the offering.

A registration statement on Form F-1 (File No. 333-234654) relating to the offering has been filed with the Securities and Exchange Commission (“SEC”) and was declared effective by the SEC on December 1, 2020. The offering of these securities will be made only by means of a final prospectus, forming a part of the effective registration statement. A copy of the final prospectus related to the offering may be obtained, when available, from ViewTrade Securities, Inc. via email: IB@Viewtrade.com or standard mail at ViewTrade Securities, Inc., 7280 W Palmetto Park Rd, #310, Boca Raton, FL 33433, Attn: Prospectus Department. In addition, a copy of the final prospectus relating to the offering may be obtained via the SEC's website at www.sec.gov.

Before you invest, you should read the final prospectus and other documents the Company has filed or will file with the SEC for more complete information about the Company and the offering. This press release shall not constitute an offer to sell, or the solicitation of an offer to buy, the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Oriental Culture Holding LTD

Oriental Culture Holding LTD is an online provider of collectibles and artwork e-commerce services, which allow collectors, artists, art dealers and owners to access an art trading market with a wider range of collectibles and artwork investors. Through its subsidiaries in Hong Kong , the Company provides trading facilitation for individual and institutional customers of all kinds of collectibles, artworks and certain commodities on its online platforms, as well as online and offline integrated marketing, storage and technical maintenance service to customers in China. For more information about the Company, please visit: www.ocgroup.hk.

Safe Harbor Statement

This press release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts. When the Company uses words such as “may, “will, “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Specifically, the Company’s statements regarding trading on the NASDAQ Capital Market and closing the initial public offering are forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the following: the Company’s goals and strategies; the Company’s future business development; financial condition and results of operations; product and service demand and acceptance; reputation and brand; the impact of competition and pricing; changes in technology; government regulations; fluctuations in general economic and business conditions in China and assumptions underlying or related to any of the foregoing and other risks contained in reports filed by the Company with the SEC. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward‐looking statements to reflect events or circumstances that arise after the date hereof.

For more information, please contact:

The Company:

IR Department

Email: IR@ocgroup.hk

Phone: +86 (025) 85766891

Investor Relations:

Janice Wang

EverGreen Consulting Inc.

Email: IR@changqingconsulting.com

Phone: +1-908-510-2351 (from U.S.)

+86 13811768559 (from China)